How to Turn Clean Energy Incentives Into Bankable Capital (Avoiding Recapture Risk)

How to Turn Clean Energy Incentives Into Bankable Capital (Avoiding Recapture Risk)

Jan 28, 2026

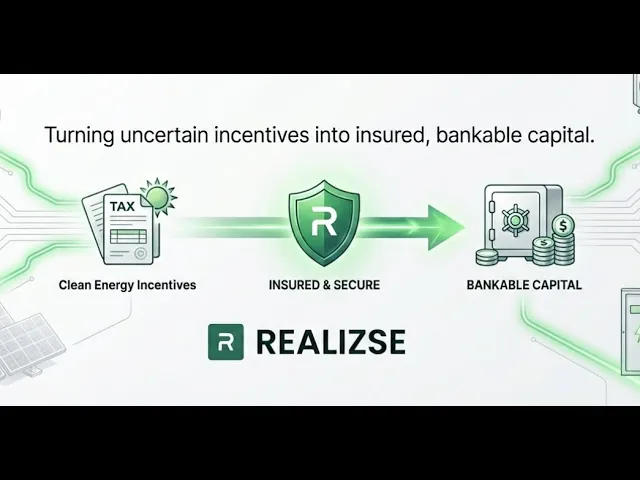

In this webinar, Eliot Assimakopoulos (CEO, Realizse) explains how clean energy incentives (federal + state) can be turned into insured, bankable capital—helping projects get financed without taking on major recapture risk.

Topics covered:

Why incentive “recapture risk” blocks project finance (and how it becomes a contingent liability)

Incentive stacking: ITC + 179D + federal/state/utility rebates (example heat pump program)

The trust problem: fragmented compliance docs, no chain of custody, limited provenance

The Realizse Passport: a cryptographically verifiable “digital twin” for project + product compliance data

How trusted data enables insurers to underwrite/price risk and unlock capital

Live product + project passport demo, plus how quotes (e.g., ITC recapture insurance, 179D) can be requested

Notable examples mentioned:

Heat pump program case study showing how stacking can scale impact vs. incentives left unused

179D overview (eligible measures; lookback window; challenges integrating into finance)

Illustrative pricing example for tax credit coverage (program-level)

Disclaimer: Realizse does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

In this webinar, Eliot Assimakopoulos (CEO, Realizse) explains how clean energy incentives (federal + state) can be turned into insured, bankable capital—helping projects get financed without taking on major recapture risk.

Topics covered:

Why incentive “recapture risk” blocks project finance (and how it becomes a contingent liability)

Incentive stacking: ITC + 179D + federal/state/utility rebates (example heat pump program)

The trust problem: fragmented compliance docs, no chain of custody, limited provenance

The Realizse Passport: a cryptographically verifiable “digital twin” for project + product compliance data

How trusted data enables insurers to underwrite/price risk and unlock capital

Live product + project passport demo, plus how quotes (e.g., ITC recapture insurance, 179D) can be requested

Notable examples mentioned:

Heat pump program case study showing how stacking can scale impact vs. incentives left unused

179D overview (eligible measures; lookback window; challenges integrating into finance)

Illustrative pricing example for tax credit coverage (program-level)

Disclaimer: Realizse does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.