Treasury’s FEOC Guidance Raises the Bar on Clean Energy Compliance — and the Need for Insurable Infrastructure

Treasury’s FEOC Guidance Raises the Bar on Clean Energy Compliance — and the Need for Insurable Infrastructure

Feb 13, 2026

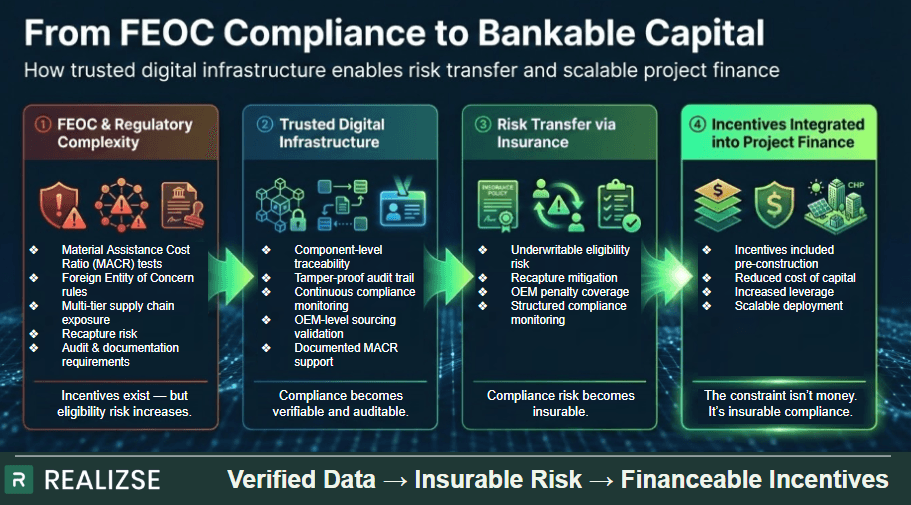

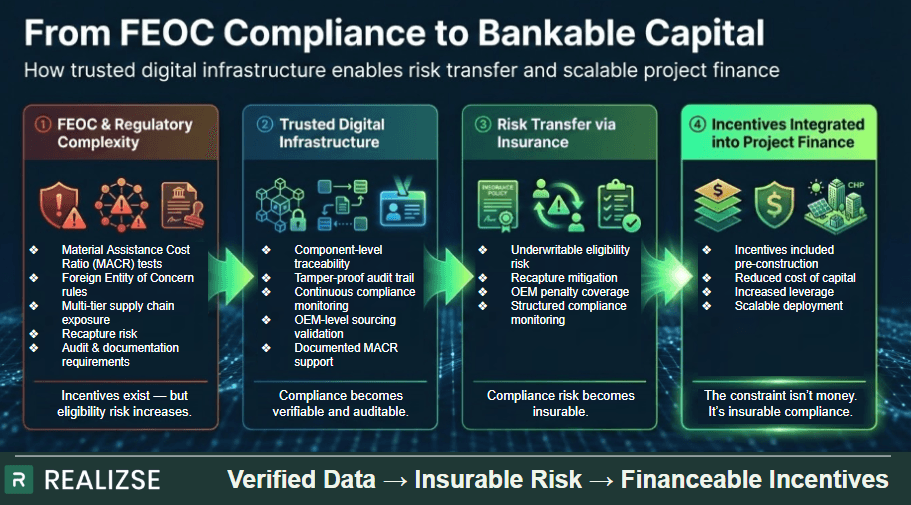

The U.S. Treasury and IRS recently released Notice 2026-15, providing initial guidance on the “Foreign Entity of Concern” (FEOC) provisions under the One Big Beautiful Bill Act.

The notice outlines how projects must evaluate whether they have received “material assistance” from prohibited foreign entities in order to remain eligible for key federal incentives, including:

§45Y Clean Electricity Production Credit

§48E Clean Electricity Investment Credit

§45X Advanced Manufacturing Credit

While the credits remain available, the compliance bar has materially increased.

What the IRS Notice Does

Notice 2026-15 introduces interim guidance and safe harbors for determining whether a project or component violates the prohibited foreign entity rules.

Key elements include:

A new Material Assistance Cost Ratio (MACR) test

Definitions of prohibited and foreign-influenced entities

Documentation expectations tied to component sourcing

Interim safe harbor tables for calculating compliance

In practical terms, this means:

Developers must trace component sourcing more precisely

Manufacturers must document ownership and influence structures

Taxpayers must be able to substantiate compliance under audit

Recapture risk increases if compliance cannot be proven

The policy objective is supply chain security.

The market impact is heightened compliance risk.

The Real Challenge: It’s Not Just Eligibility — It’s Verifiability

Most clean energy projects now involve:

Multi-tier global supply chains

OEM components sourced from multiple jurisdictions

EPC contractors across multiple entities

Layered federal, state, and utility incentives

The FEOC regime doesn’t just require compliance.

It requires provable, auditable compliance over time.

Without verifiable traceability:

Incentive proceeds may be excluded from financing

Insurers may refuse to underwrite eligibility

Tax equity and direct pay investors may discount value

Recapture risk increases

In other words, incentives remain available — but they are no longer automatically bankable.

Why Digital Product & Project Passports Matter Now

At Realizse, we have built cryptographic, tamper-proof Digital Product and Project Passports specifically to operate in this new regulatory environment.

Our passports function as digital twins of clean energy assets and components — anchoring verified supply chain, sourcing, and compliance data to immutable records. The framework is architected to align with emerging global standards, including the EU Digital Product Passport (DPP) requirements, which are setting a precedent for traceable, verifiable product-level compliance across markets.

Our passports:

Anchor component-level data to cryptographically secure records

Create an immutable digital twin of the asset and its supply chain lineage

Track OEM sourcing and foreign influence exposure

Maintain continuous compliance documentation across the project lifecycle

Provide a tamper-proof, auditable compliance record

For FEOC compliance, this enables:

Traceability of components through multi-tier suppliers

Documentation of ownership and foreign influence thresholds

Evidentiary support for Material Assistance Cost Ratio (MACR) calculations

Continuous monitoring throughout the statutory recapture period

This is not simply documentation storage.

It is a cryptographically verifiable compliance infrastructure.

In an environment where eligibility can determine the viability of an entire financing structure, the result is not just data — it is a defensible framework of trust.

From Compliance to Risk Transfer

Compliance alone does not unlock capital.

Compliance must be insurable.

Realizse integrates passport data directly into insurance underwriting. This enables:

Transfer of eligibility and recapture risk

Insured incentive proceeds

Integration of credits into project finance structures

Capital stack inclusion prior to construction

The telematics analogy applies here as well:

Just as insurers price vehicle risk using real driving data, we enable insurers to price incentive eligibility risk using verified supply chain and compliance data.

When FEOC compliance is digitally verified and continuously monitored, insurers can underwrite that risk — and capital providers can finance against it.

Extending Protection to OEMs

The new FEOC regime also creates exposure for equipment manufacturers.

OEMs face:

Potential disqualification of projects using their equipment

Loss of market share due to compliance uncertainty

Reputational risk

Downstream recapture exposure

By integrating Digital Product Passports at the OEM level:

Manufacturers can provide compliant, traceable components

Risk of penalties and disqualification can be mitigated

Insurance solutions can be structured around component compliance

Developers gain confidence in procurement decisions

This creates alignment across the ecosystem:

OEM → Developer → Insurer → Capital Provider

All operating on shared, verifiable data.

The Policy Signal Is Clear

Treasury’s FEOC guidance signals a structural shift:

Clean energy incentives are no longer just policy tools.

They are regulated financial instruments with supply chain compliance attached.

In this environment:

The constraint isn’t money.

It’s insurable, verifiable compliance.

As compliance complexity increases, trusted digital infrastructure becomes foundational to deployment at scale.

The U.S. Treasury and IRS recently released Notice 2026-15, providing initial guidance on the “Foreign Entity of Concern” (FEOC) provisions under the One Big Beautiful Bill Act.

The notice outlines how projects must evaluate whether they have received “material assistance” from prohibited foreign entities in order to remain eligible for key federal incentives, including:

§45Y Clean Electricity Production Credit

§48E Clean Electricity Investment Credit

§45X Advanced Manufacturing Credit

While the credits remain available, the compliance bar has materially increased.

What the IRS Notice Does

Notice 2026-15 introduces interim guidance and safe harbors for determining whether a project or component violates the prohibited foreign entity rules.

Key elements include:

A new Material Assistance Cost Ratio (MACR) test

Definitions of prohibited and foreign-influenced entities

Documentation expectations tied to component sourcing

Interim safe harbor tables for calculating compliance

In practical terms, this means:

Developers must trace component sourcing more precisely

Manufacturers must document ownership and influence structures

Taxpayers must be able to substantiate compliance under audit

Recapture risk increases if compliance cannot be proven

The policy objective is supply chain security.

The market impact is heightened compliance risk.

The Real Challenge: It’s Not Just Eligibility — It’s Verifiability

Most clean energy projects now involve:

Multi-tier global supply chains

OEM components sourced from multiple jurisdictions

EPC contractors across multiple entities

Layered federal, state, and utility incentives

The FEOC regime doesn’t just require compliance.

It requires provable, auditable compliance over time.

Without verifiable traceability:

Incentive proceeds may be excluded from financing

Insurers may refuse to underwrite eligibility

Tax equity and direct pay investors may discount value

Recapture risk increases

In other words, incentives remain available — but they are no longer automatically bankable.

Why Digital Product & Project Passports Matter Now

At Realizse, we have built cryptographic, tamper-proof Digital Product and Project Passports specifically to operate in this new regulatory environment.

Our passports function as digital twins of clean energy assets and components — anchoring verified supply chain, sourcing, and compliance data to immutable records. The framework is architected to align with emerging global standards, including the EU Digital Product Passport (DPP) requirements, which are setting a precedent for traceable, verifiable product-level compliance across markets.

Our passports:

Anchor component-level data to cryptographically secure records

Create an immutable digital twin of the asset and its supply chain lineage

Track OEM sourcing and foreign influence exposure

Maintain continuous compliance documentation across the project lifecycle

Provide a tamper-proof, auditable compliance record

For FEOC compliance, this enables:

Traceability of components through multi-tier suppliers

Documentation of ownership and foreign influence thresholds

Evidentiary support for Material Assistance Cost Ratio (MACR) calculations

Continuous monitoring throughout the statutory recapture period

This is not simply documentation storage.

It is a cryptographically verifiable compliance infrastructure.

In an environment where eligibility can determine the viability of an entire financing structure, the result is not just data — it is a defensible framework of trust.

From Compliance to Risk Transfer

Compliance alone does not unlock capital.

Compliance must be insurable.

Realizse integrates passport data directly into insurance underwriting. This enables:

Transfer of eligibility and recapture risk

Insured incentive proceeds

Integration of credits into project finance structures

Capital stack inclusion prior to construction

The telematics analogy applies here as well:

Just as insurers price vehicle risk using real driving data, we enable insurers to price incentive eligibility risk using verified supply chain and compliance data.

When FEOC compliance is digitally verified and continuously monitored, insurers can underwrite that risk — and capital providers can finance against it.

Extending Protection to OEMs

The new FEOC regime also creates exposure for equipment manufacturers.

OEMs face:

Potential disqualification of projects using their equipment

Loss of market share due to compliance uncertainty

Reputational risk

Downstream recapture exposure

By integrating Digital Product Passports at the OEM level:

Manufacturers can provide compliant, traceable components

Risk of penalties and disqualification can be mitigated

Insurance solutions can be structured around component compliance

Developers gain confidence in procurement decisions

This creates alignment across the ecosystem:

OEM → Developer → Insurer → Capital Provider

All operating on shared, verifiable data.

The Policy Signal Is Clear

Treasury’s FEOC guidance signals a structural shift:

Clean energy incentives are no longer just policy tools.

They are regulated financial instruments with supply chain compliance attached.

In this environment:

The constraint isn’t money.

It’s insurable, verifiable compliance.

As compliance complexity increases, trusted digital infrastructure becomes foundational to deployment at scale.